option to tax unit

Following this we were. Employees portion of Social Security Tax for 2021 is 62.

Tax Declaration On Employer Shares Hth Accountants

The maximum wages and earnings subject to.

. Anybody dealing with HMRCs Option To Tax Unit will know that they currently have significant backlogs to deal with. The option to tax rules have been with us a long time since 1 August 1989 to be exact. An option to tax election is always made on land it then applies to any building that is constructed on the land apart from housing.

As a tip to finding out the progress of your application it might be worth emailing the Option to Tax Unit at optiontotaxnationalunithmrcgsigovuk Belated notifications There. HMRC have no central record of options notified before then. With examples of it taking.

We have received reports from members of continuing delays by the Option to Tax National Unit in responding to options that have been notified. Although an HMRC acknowledgment is not legally required. An option to tax is considered to be the clearest evidence that the taxpayer intends his supplies to be taxable though it should be remembered that an option to tax is disapplied in respect of.

Self-Employment Tax contains Social Security Tax and Medicare Tax. You can email notifications to optiontotaxnationalunithmrcgovuk. Option to Tax National Unit Cotton House 7 Cochrane Street Glasgow G1 1GY Phone 0141 285 4174 4175 Fax 0141 285 4423 4454 Unless you are registering for VAT and.

This means that many property owners will have sent their option to tax elections to. So a new office block built on opted land is. The aim of the trial is to speed up our review process by increasing internal efficiency while maintaining our legislative.

Option to tax national unit cotton house 7 cochrane street glasgow g1 1gy phone 0141 285 4174 4175 fax 0141 285 4423 4454 unless you are registering for vat and also. During the early stages of COVID-19 we allowed businesses or agents to notify an option to tax with. I noticed today that the Option to Tax Unit have altered their voice message and are no longer accepting external phone calls.

Although the option to tax was introduced in 1989 the Option to Tax Unit was only formed in 2003. As a tip to finding out the progress of your application it might be worth emailing the Option to Tax Unit at optiontotaxnationalunithmrcgsigovuk Belated notifications There are two. Option to Tax.

The investor buys the option for 1 or 100 total as each contract represents 100 shares. Internal Revenue Code section 1256 requires options contracts on futures commodities currencies and broad-based equity indices to be taxed at a 6040 split between. Bearing in mind that their last.

We recently shared that we had been advised by HMRCs OTT unit that they were working to a target of 120 working days to process OTT notifications. From 30052022 will begin a trial within Option to Tax. The stock trades at 22 upon expiry and the investor exercises the option.

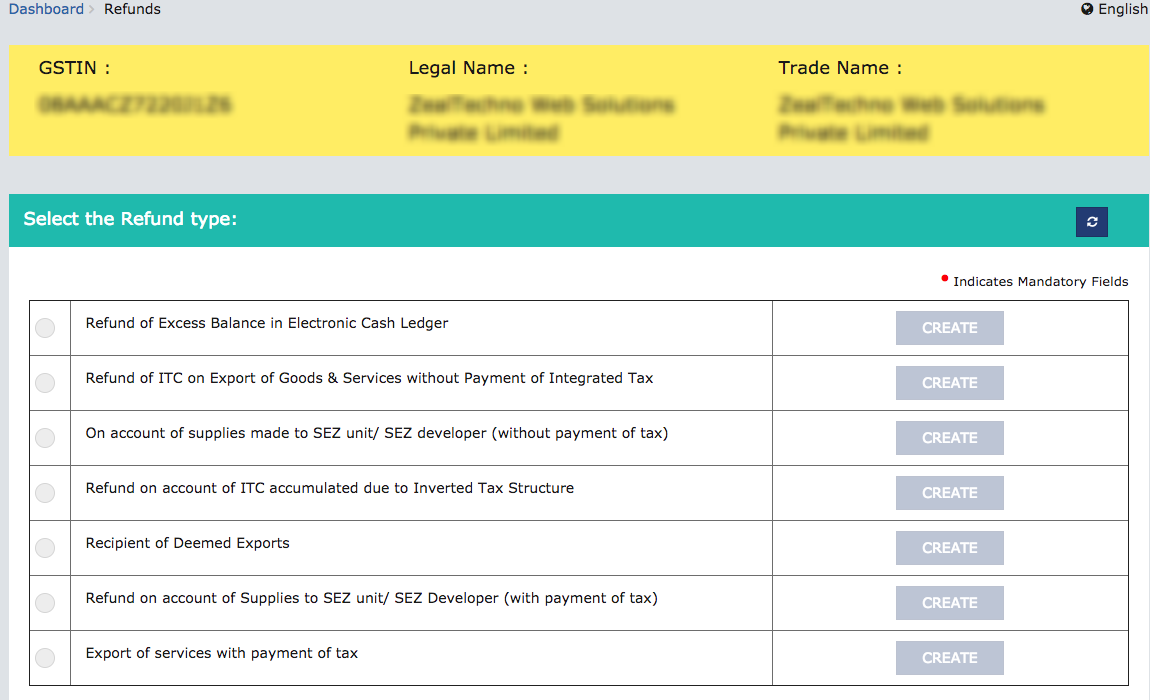

Refund Of Unutilised Input Tax Credit For Zero Rated Supplies Taxadda

![]()

Option To Tax Explained Martin Aitken Co Chartered Accountants

Creating A Tax Unit Service Tax

Audit Procedures Iota Report For Tax Administrations Pdf Free Download

Income Tax Deadline Tax Administration Jamaica Facebook

European Union Value Added Tax Wikipedia

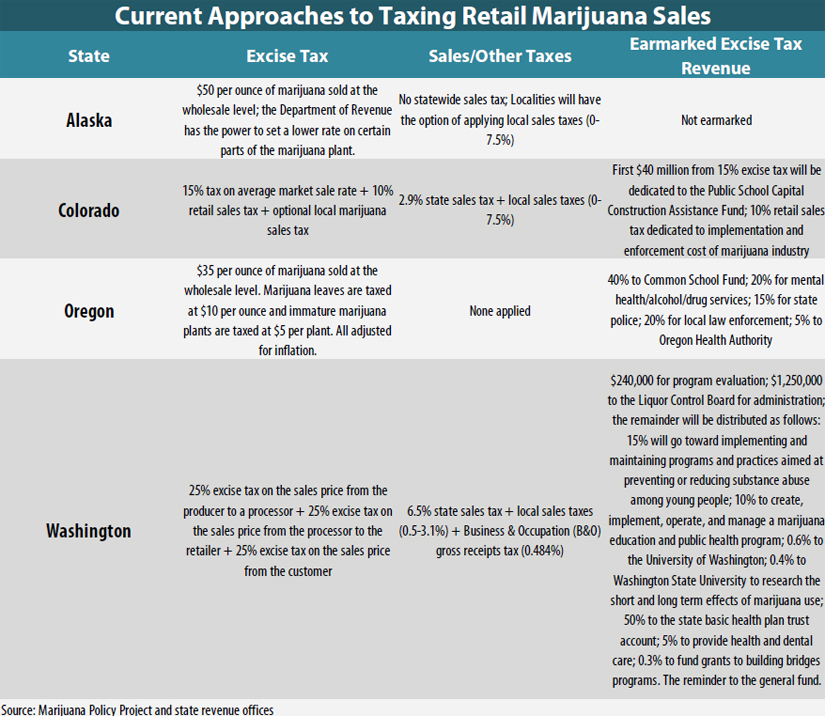

Issues With Taxing Marijuana At The State Level Itep

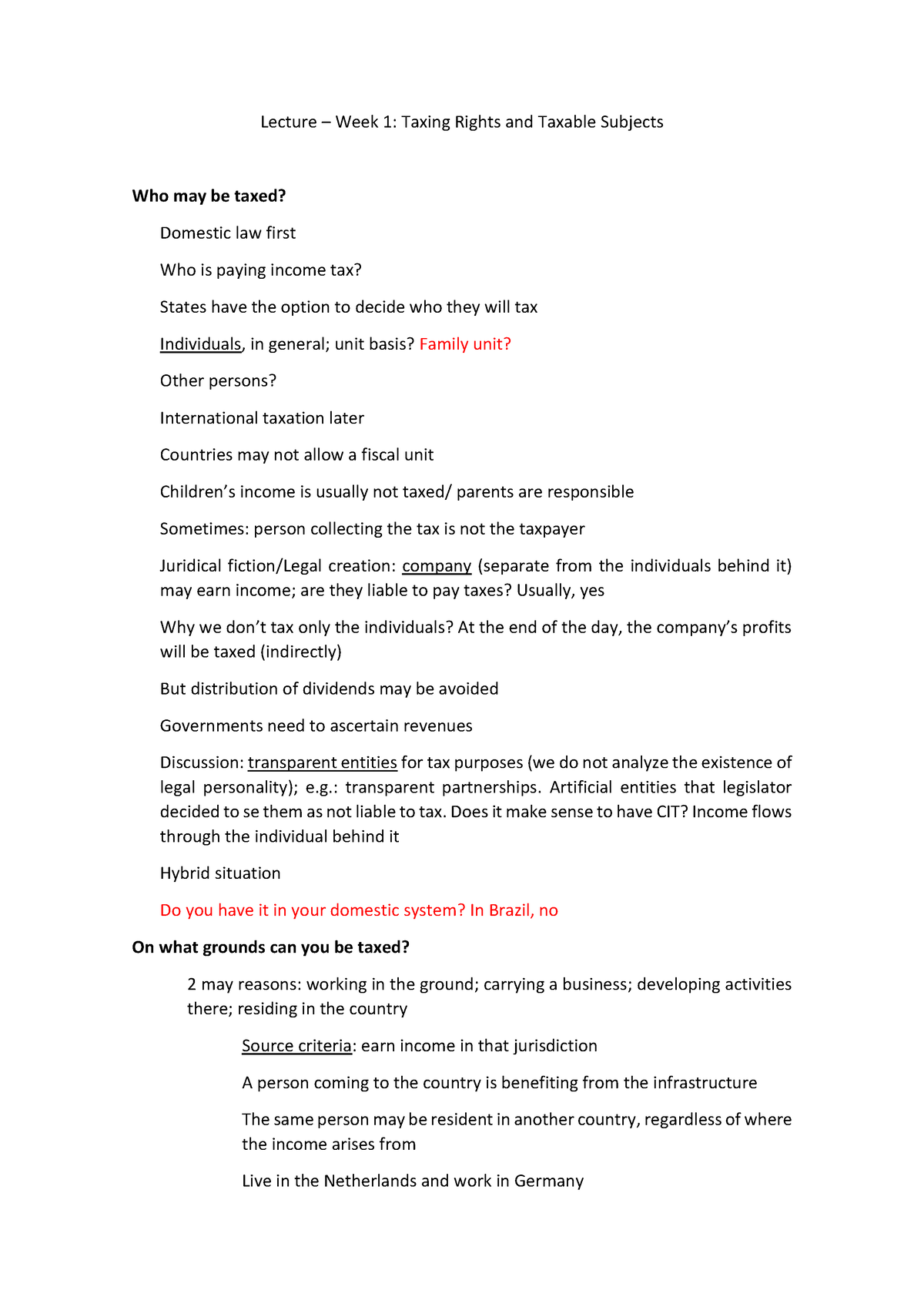

Lecture Fundamentals International Taxation Week 1 Lecture Week 1 Taxing Rights And Taxable Studeersnel

Impact Of Minimum Unit Pricing On Alcohol Purchases In Scotland And Wales Controlled Interrupted Time Series Analyses The Lancet Public Health

Service Tax In Tally Prime Last Date

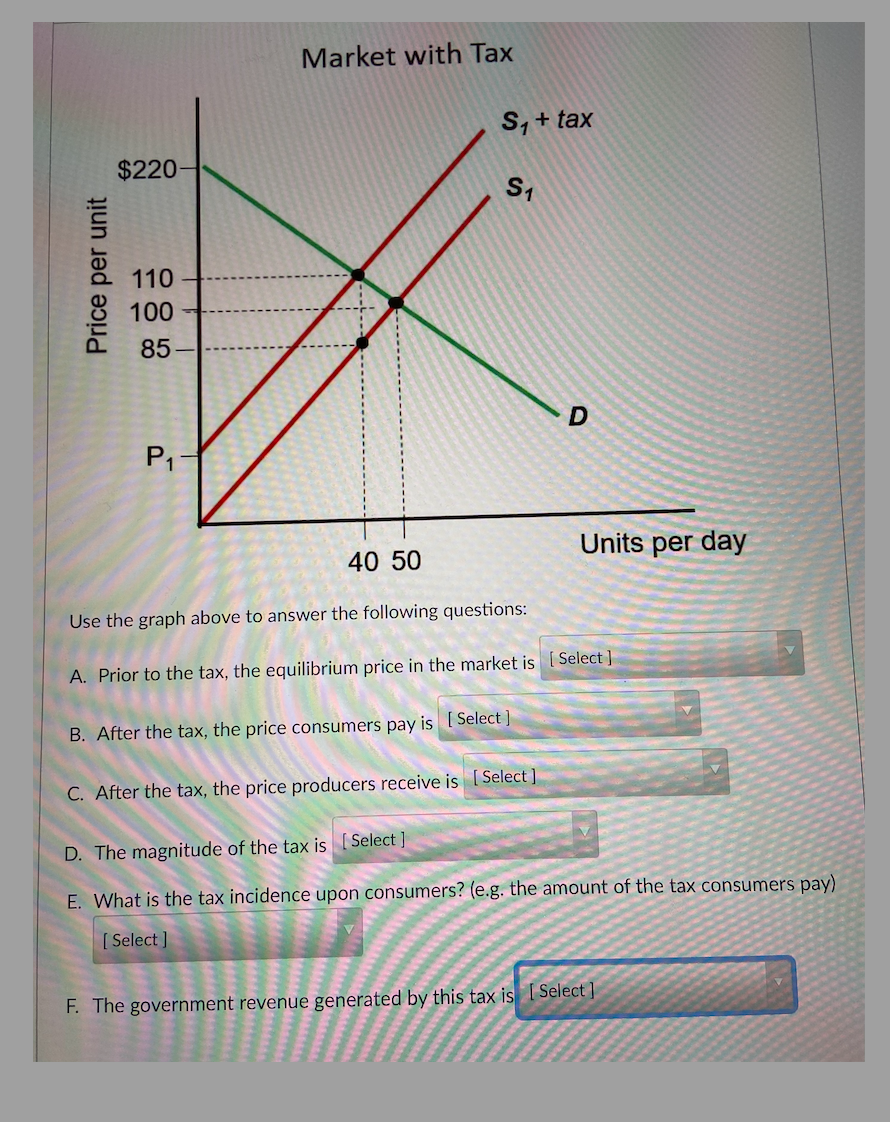

Solved Option A 100 85 110 10 220 Option B 110 Chegg Com

Tax Structure In India Learn Indian Tax System Taxation In India

Amt Know About Alternative Minimum Tax Applicability Exemptions Credits More

Malta Malta Publishes Tax Grouping Rules International Tax Review

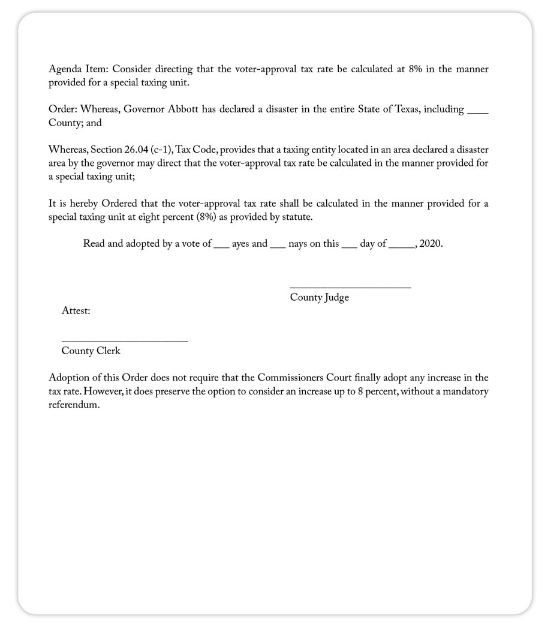

Senate Bill 2 County Budgets During A Pandemic Texas County Progress

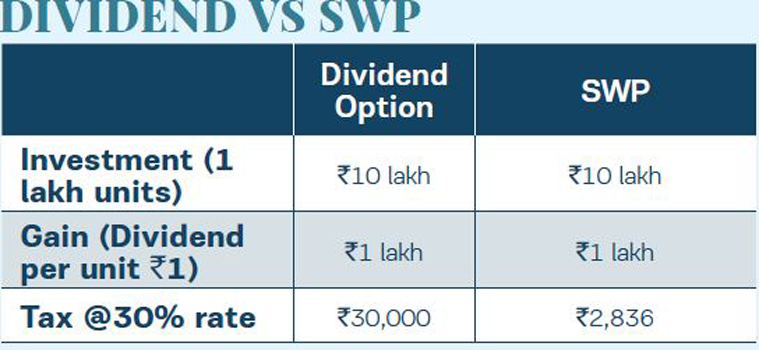

Tax Saving Investments Double Benefit Here Are 6 Tax Saving Investments With Tax Exempt Returns The Economic Times